How to earn $1000 in CashBack through Credit Cards

Earn $1,000+ cash back by using credit cards wisely! Use BILT for rent rewards, Discover for 5% rotating bonus categories, and Bank of America for 3% customizable categories. Pay balances monthly to avoid interest, and turn everyday spending into easy savings with minimal effort.

Credit cards aren’t just a convenient alternative to cash; they can also be a fantastic way to save money and earn rewards—if used wisely. With the right strategy, it’s possible to earn $1,000 or more in cash back in a year without spending beyond your means. Here’s how you can make the most of your credit cards while avoiding costly pitfalls.

Basics of Credit Card Rewards

Most credit cards offer some type of cashback or rewards program. Typically, you earn at least 1% cash back, meaning for every $100 spent, you get $1 back. However, some cards offer significantly higher rewards in certain categories or through partnerships.

While credit cards are handy, they come with a major caveat: interest rates. If you don’t pay off your balance in full each month, you’ll be hit with interest rates exceeding 20%, which can quickly outweigh any cashback benefits. Always pay your credit card bill in full and on time to maximize rewards withouts financial stress.

How We Earned $1,100 in Cash Back

In 2024, my household of two (my husband and I) used three different credit cards: Bank of America, Discover, and BILT; to earn over $1,100 in cash back. Here’s the breakdown of how we did it:

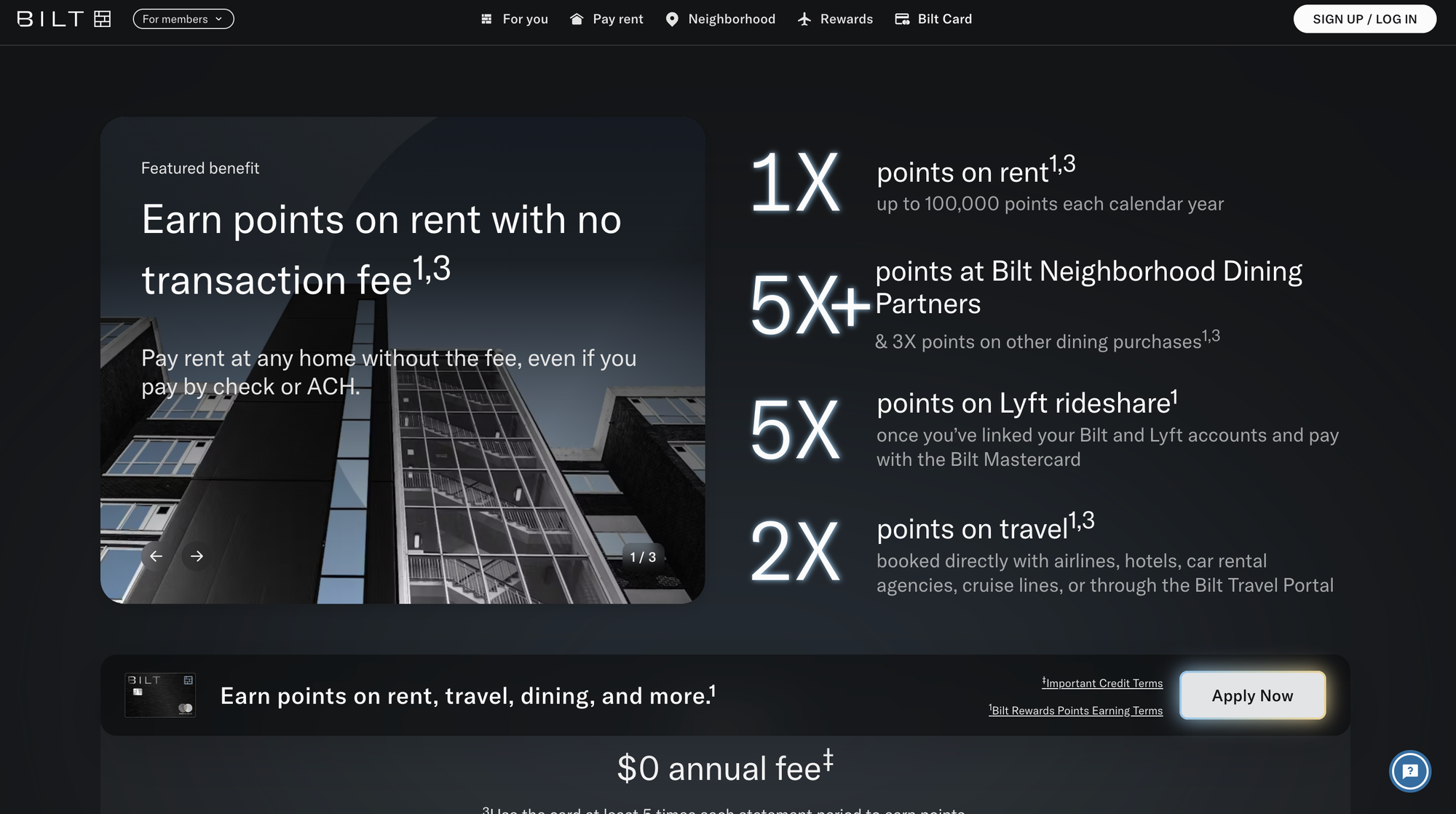

1. Bilt Rewards: $300+

BILT is the only credit card currently offering cashback on Rent and Mortgage. If you pay $2000 in rent, you will get 2000 points every month. However, converting points to cash is not very straightforward.

Travel points: If you use these points to book Bilt’s airline or hotel partners, you get 1.65 to 2 cents per point. This is 1.65% to 2% cashback.

BILT Travel Portal: If you book your travel through BILT’s travel portal, 1 point will equal 1.25 cents or 100 points will give you $1.25 i.e., 1.25% cashback.

Rent Payments: You can use these points for rent payments as well, but then each point will equal 0.55 cents or 0.55% cashback.

Amazon Purchases: You can also use these points at amazon.com yielding 0.7 cents per point or 0.7% cashback.

So, next time you travel, book with BILT’s airline and hotel partners, or at least through BILT’s travel portal.

Last year, I traveled to Pakistan (from the USA) during the off-season. My return ticket cost around $1000, but I used all my BILT points (accumulated in the past six months), so my fare came down to $700. Hence, the more often you travel, the more you can benefit from the BILT rewards program.

However, there are some terms and conditions. You have to make at least 5 purchases every month (including your rent) to be able to earn the cashback rewards.

Bonus Points

3X Points or 5% Cashback

With a BILT credit card, you normally get 1 point for each dollar spent. But on dining (all the restaurants), you get 3X points i.e., 3 points for each dollar spent. If you spend these points on travel, you will get $4.95-$6 per $100 spent. This is around 5% or more in cashback. The best part is, Uber Eats and Grubhub also count as dining with BILT rewards, so next time you dine in a restaurant or take out food, use your BILT credit card to pay!

2X Points or 4% Cashback

When you use your BILT credit card for travel (booking a hotel or flight and car rentals) you get 2X points i.e., 2 points per dollar spent. If you spend those points on travel, you will get 3.3-4 cents per point or 3.3% to 4% Cashback. You also get 2X points on LYFT, but not Uber.

Double Points on Rent Day

On the first day of every month, you get double points on everything i.e., 6X points on dining, 4X points on travel, and 2X points on everything else.

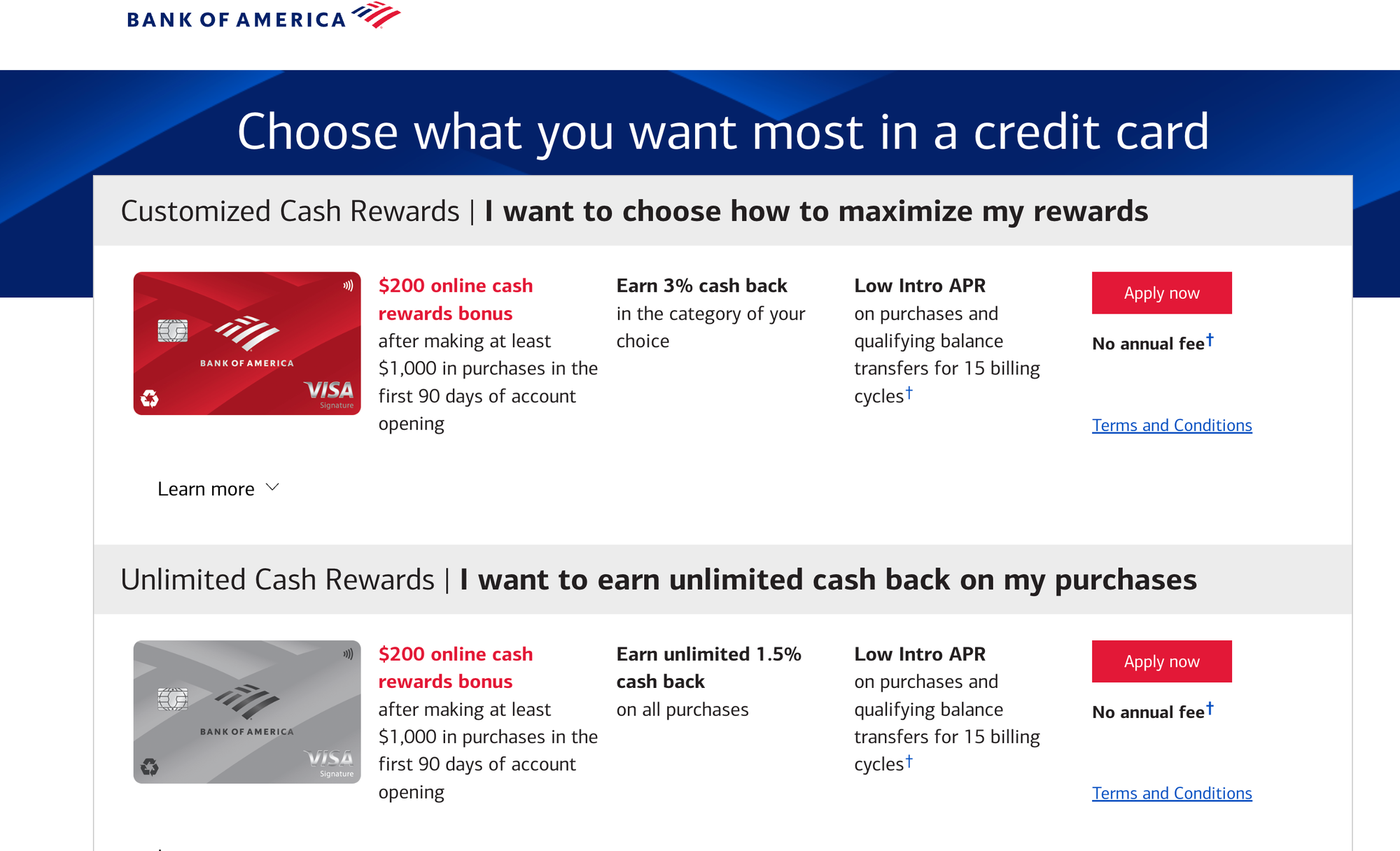

2. Bank of America (BOA): $500+

Bank of America has a great cashback rewards program.

3% cashback categories

You can choose 1 from 6 categories to earn 3% cashback. The 6 categories are

- Online Shopping

- Gas and EV Charging

- Dining

- Drug Stores

- Home Improvement and Furnishing

- Travel

Since we use our BILT card for travel and dining, we have chosen Online Shopping as our 3% cashback category. During the holiday season, we spent more than $1000 on online shopping (mostly on Amazon.com), so we earned more than $30 in cashback from this category alone.

This is especially useful when we make a big purchase, like a laptop, or jewelry, etc. We even try to buy most of our clothes online so that we can get 3% cashback on them as well.

2% Cashback Categories

Bank of America (BOA) offers 2% cash back on grocery stores and wholesale clubs. Note that Walmart and Target DO NOT count as grocery stores at BOA. When we shop for groceries at Walmart or Target, we mostly pay with BILT or Discover, while at all other grocery stores and wholesale clubs, we pay with BOA.

On all other purchases, you get 1% cash back (1$ back on every $100 spent) at BOA. On average, we earn about $50 in cash back at BOA every month.

$75 cashback limit per quarter

There is a limit that in bonus categories (in which you earn 3% and 2% cash back), you can earn a maximum of $750 in cash back in a single quarter. Once this limit is reached, you earn 1% on all the purchases in all the categories. On special occasions, like when we moved our house this year, we did reach this category which is actually a good thing because this means that we are earning maximum cash back.

3. Discover: $300+

The third and final credit card we use is Discover. It is separate from Visa and Mastercard, so it is not accepted by many small merchants and cannot be used for international transactions. However, it is widely accepted at all the major stores throughout the USA.

5% Cashback categories

Discover offers unlimited 1% Cashback on all purchases. In addition to that, it offers a whopping 5% cash back on rotating categories each quarter. The 5% cashback applies to up to $1,500 in purchases in the bonus categories per quarter (then 1% after reaching the cap).

These bonus categories change every quarter but mostly revolve around Amazon.com, Target, Walmart, Gas and Charging Stations, Drugstores, and Restaurants. Discover’s bonus categories right now (for the first quarter of year 2025) are Restaurants, Home Improvement stores and selected streaming services.

We pay our streaming services through Bank of America’s credit card, earning 3% cash back, and we don’t like to go through the hassle of changing the payment information in all the streaming services we use.

Note: this category includes all the major streaming services like

- Amazon Music

- Amazon Prime Video

- AMC+

- Apple Music

- Apple TV

- Audible

- DirecTV Stream

- Fubo

- Google Play Music and Video

- HBO Max

- Hulu

- Netflix

- Pandora

- Peacock

- SiriusXM

- Sling TV

- Spotify

- Starz

- YouTube Premium

- YouTube TV

Unfortunately, Homegoods, TJ Maxx, etc do not count as home improvement stores at Discover and this is where we mostly shop for home improvement items. However, if you shop at Home Depot or Lowe’s, you can earn 5%cash back on your purchases during this quarter.

During the quarter when Discover offers 5% cash back on restaurants, we always pay for our food with the Discover card and reach our $75 cash back limit for that quarter. Uber Eats is also included in the restaurants here.

For the last quarter (Oct-Dec 2024), the 5% Bonus categories were Amazon.com and Target. During the last 3 months, we did most of our groceries at Target and used the Discover card for shopping at amazon.com.

Until last year, we did our groceries through amazon fresh and used to always reach the $75 cash back limit during the quarter in which amazon.com was the bonus category. Now we do most of the shopping from Walmart or Target, and this is the first time we did not reach the $75 limit.

One important thing to note is that you have to manually activate the 5% bonus categories each quarter on the Discover website or app.

Rewards Redemption

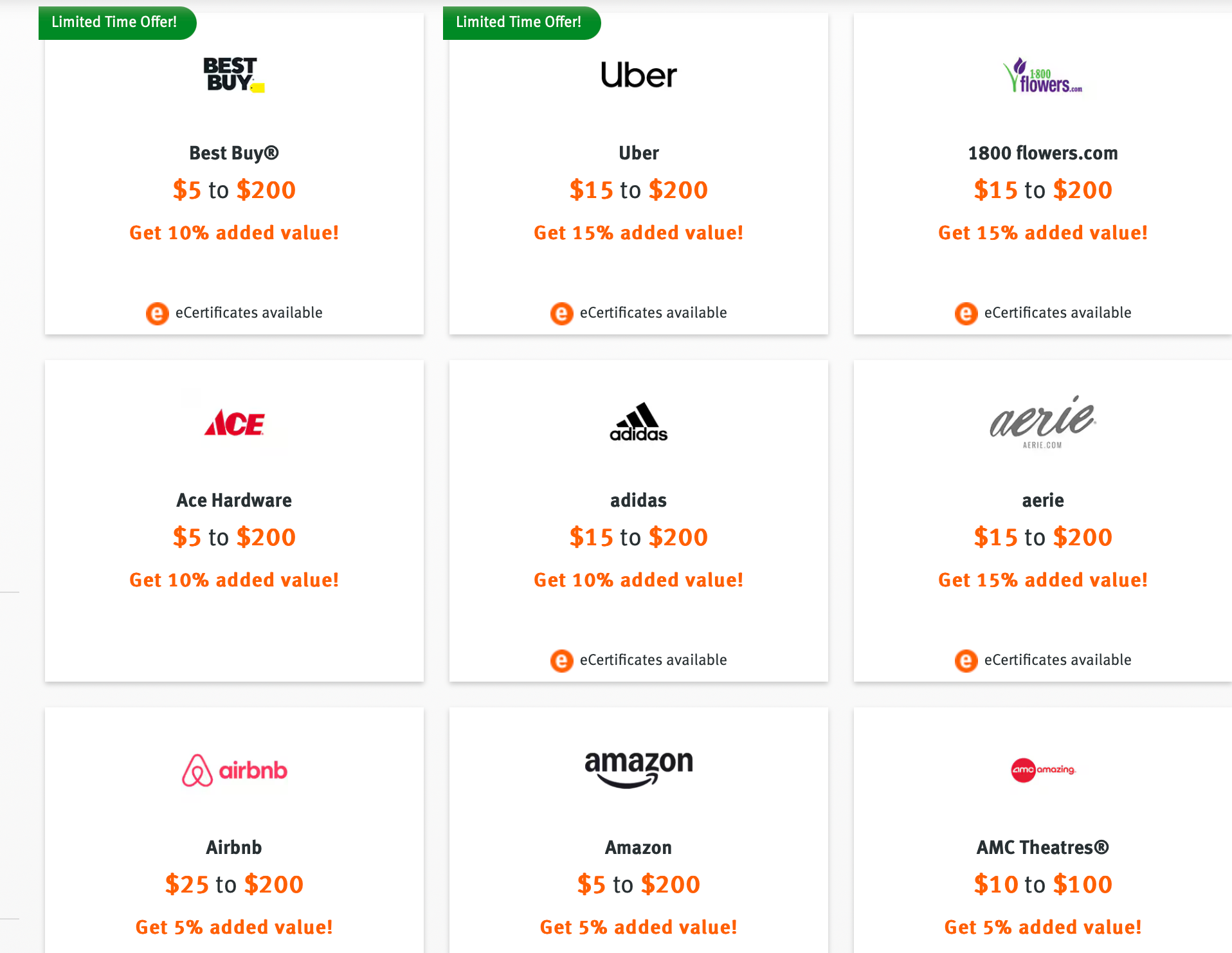

You can directly deposit this cash-back balance into your bank account or use this balance to pay your credit card bill. However, the best way to use this balance is to buy gift cards as they offer 5% to 15% higher redemption value. Some popular merchants that offer gift cards here are amazon.com, Best Buy, Walmart, Wayfair, Adidas, Uber, Nike, Nordstrom, and many many more.

Conclusion

This is how we earned $1000 in cash back in the year 2024. We are a very small household. If you have a bigger household, you will spend more and consequently earn more in cash back.

Note that all the credit cards we use are free. There are some other credit cards that have annual fees (in the $100s) but their cash-back offers are much better and you can easily earn back the annual fees you pay, and then some.

Final Thoughts

Earning $1,000 in cash back isn’t just achievable, it’s easy with a bit of planning and discipline. By selecting the right credit cards and aligning them with your spending habits, you can turn everyday expenses into significant savings. Just remember: the key to success is responsible credit card use. Happy earning!